Don’t let term sheets trip you up. Dentons associate Joe Collingwood and Aura founder Ataer Arguder explain term sheet basics for the early stage founder, and break down how to think strategically about yours.

For early-stage founders, the term sheet is among the most consequential documents you’ll develop. Your term sheet — basically a written agreement dictating the terms and conditions of a deal — serves a critical role in the fundraising process, and can carry implications for your startup’s ownership structure in the long term. But managing term sheets doesn’t need to be a scary process.

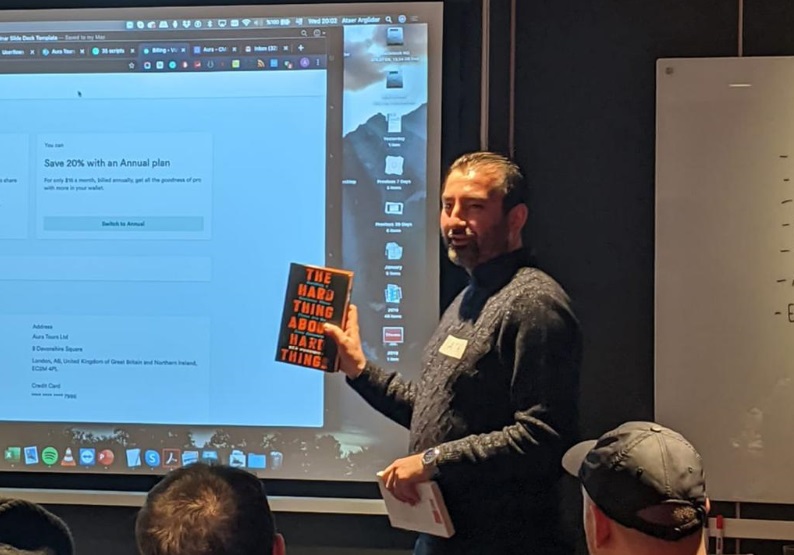

“For somebody going through the fundraising process for the first time, there can be a lot of jargon and unfamiliar terms in those term sheets,” says Joe Collingwood, associate in Dentons’ corporate practice. Along with Ataer Arguder, Founder of Aura and head of Founders Network London chapter, Collingwood breaks down the fundamentals of term sheets and ways to think strategically about crafting yours.

If you’re an early stage founder, register for the full Term Sheets 101 seminar and check if you qualify for membership to Founders Network and learn term sheet essentials, including:

- Understanding VCs

- Setting a Valuation

- Liquidation Preferences

- Founder Vesting

- Anti-Dilution Clauses + More

“A term sheet is basically a letter of intent: summary of mutual understanding of what’s going to happen when,” says Arguder. “Founders don’t really know how this works from the VC’s side, what the fund needs to do to make money — the dynamics, the math. Once a founder understands how this works, I think it’s easy to reverse-engineer the process and become VC ready.”

Founders, particularly, first-time founders, are likely to encounter a bunch of terminology that they may not fully comprehend: Liquidation preferences, founder vesting, anti-dilution clauses, straight line vesting, preemption rights, just to name a few.

“Both sides need to be very careful, because this round’s term sheet is the next round’s starting point. Valuation is critical.” - @ataerarguder Share on X “Both sides need to be very careful, because this round’s term sheet is the next round starting point,” adds Arguder. “In 18 to 24 months, you’re required to perhaps triple your business. So valuation is critical.”

“Both sides need to be very careful, because this round’s term sheet is the next round starting point,” adds Arguder. “In 18 to 24 months, you’re required to perhaps triple your business. So valuation is critical.”

Founders shouldn’t fall into the trap of seeking a higher valuation because it sounds more prestigious, or has the potential to attract more media attention, according to Arguder.

“It’s a great burden on the founder as well,” he says. “The term sheet is sent by the VC, by the way. And if you’re not an experienced founder, you may not think like three or four steps ahead.”

“It’s essential for founders to get legal counsel in evaluating term sheets, and to square that advice with their own goals with the business. That can start with knowing how to spot what’s standard — and what isn’t — in basic terms such as liquidation preferences,” adds Collingwood.

“It’s fairly standard to see a one times liquidation preference, which means if a company goes, bust the investor gets an amount equal to their investment back in priority to everybody else.

“But if you’ve never seen that before, you’d have no idea of knowing whether or not that’s normal or not,” says Collingwood. The higher the number floats above one, the more favorable it tends to be towards the investor.

“If a founder understands why a VC is asking for something, it can make negotiations a bit smoother.” - @Dentons Share on XAnother challenge is understanding where to pick your battles and that starts with understanding the investors’ rationale in asking for specific terms — liquidation or otherwise.

“If a founder understands why a VC is asking for something, it makes negotiations a bit smoother,” Collingwood says. ”Frankly, there are places where VC funds just won’t budge; they will expect a liquidation preference 95% of the time. So it’s not really worth fighting that battle.”

“A deeper understanding of your investors’ motivations, and how they’re aiming to make money off the investment will likely yield a stronger term sheet for both parties,” says Arguder.

“As well as building a small business; you're building a growth machine. Term sheets need to be realistic because a VC wants to make an exit in the future.” - @ataerarguder Share on X“You’re not building a small business; you’re building a growth machine — that’s the idea at least,” he says. “Term sheets need to be realistic, because a VC wants to make an exit at some point in the future. There are going to be other rounds, and maybe they’ll want to go to a bigger VC and sell their shares. The expectations of a founder need to be managed.”